Innovative information technologies, new ideas aimed at creating a safe and comfortable life, as well as providing a solution to a specific problem, form the basis of startups, which over time turn into profitable and popular businesses. The main trends on the IT market are “breakthrough” technologies in the areas of blockchain, facial recognition, artificial intelligence, augmented reality, cybersecurity, Big Data, and mobile payments.

Technological startups are in demand, bringing their creators recognition and huge profits if they are successfully implemented. But not all worthy ideas come to fruition, often getting bogged down at the stage of searching for funding to continue research and create the final product. How to find an investor and present a startup to him is a serious question, the answer to which affects a good half of success.

Most often, investments are in demand for a startup at the idea stage and for a proven business model hypothesis that already has a prototype and first sales. When a startup is faced with finding an investor for the first time, the process seems arduous and difficult.

Important points:

- The size of the presentation matters.

- You can’t get investment quickly at the seed stage.

- The quality of the meeting with investors is much more important than the quantity.

- The presentation must be perfect.

- The unnecessary finance slide is the most watched.

- The less time it takes to pitch, the longer it takes to prepare for it.

It is important for the investor to assess the level of “maturity” of the project, on which depends its success and the possible amount of financing. At the seed stage there is no business plan, the development is at the testing stage, the initial marketing analysis is being conducted. Investments at this stage are considered the riskiest.

When a startup has a viable product and confirmed demand, data on the target audience have been collected and a business model has been established, investors are more willing to invest in the development of such a company.

How to develop a successful presentation of an IT startup

The purpose of the presentation is to make a good impression, to demonstrate professionalism, and to stimulate interest. As a rule, presentations are sent to investors by email for review. It should be self-sufficient. The main goal at this stage is concreteness, the achievement of action, which is taken spontaneously – an appointment.

Investors are not ready to look through long “sheets” and delve into an abundance of letters and numbers. Everything should be concise and clear, catching the eye at a glance. The presentation should be readable both from a PC and from mobile devices. Time for full reading of the presentation by e-mail is no more than two minutes.

Optimal number of slides – 10, but no more than 20. Small number of slides is an indicator of thoughtfulness, long preparation, ability to appreciate investor’s time and serious attitude to the project. In order not to be eliminated at the stage of accepting applications to gas pedals, it is advisable not to overuse the number of slides and the abundance of calculations and tables.

The total time for a pitch (a short presentation given in person) is no more than three and a half minutes. During this time, the idea of the startup must be outlined, to interest the investor and attract investments.

If the pitch is assessed as interesting and the startup is promising, the investor asks for more information and questions. The degree of informativeness of the presentation often shows whether the startup is worth the required investment. If he succeeds in convincing the investor, he will bring the project founder closer to developing his own business.

A presentation for a personal meeting should be prepared separately, since only the visual component is shown on the screen, and all information is explained orally. It is mandatory to emphasize the importance of the problem and people’s interest in solving it, to describe the market, the target audience, and the uniqueness of the startup.

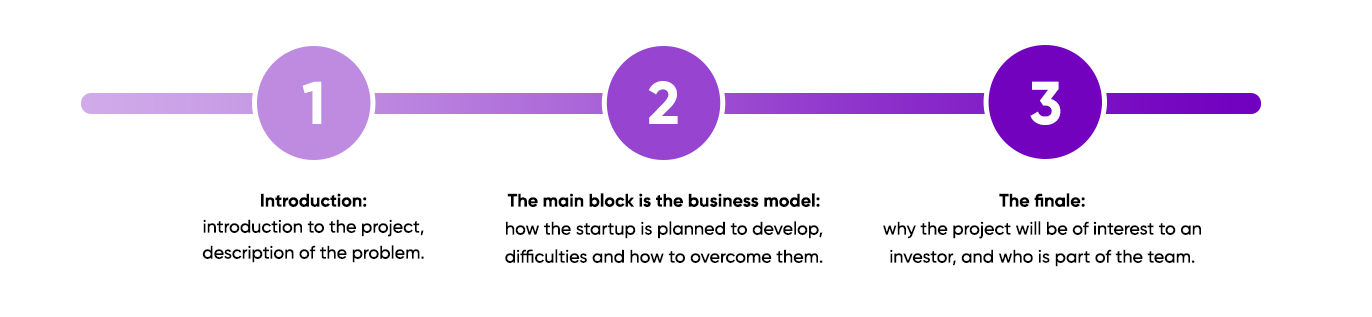

The structure of the presentation is typical, the differences concern the arrangement of the information. In some cases, it is appropriate to divide the most informative points into several pages. Structurally, the presentation is divided into sections:

- Introduction: introduction to the project, description of the problem. This is basic information, conveying the essence of the startup in literally a few words.

- The main block is the business model: how the startup is planned to develop, what difficulties exist on the way to development and how to overcome them. The shorter and more descriptive the presentation, the better.

- The finale: why the project will be of interest to an investor, and who is part of the team. The decision to invest depends solely on the actual performance, prospects, and skills of the team members.

The main slides to pay attention to when creating a presentation:v

- Title. It contains the startup’s name, logo, slogan, and contact information.

- The problem the startup will help solve. Its impact on people’s lives and on doing business. Proof is required as to why this solution should be chosen, using a specific IT startup.

- Value Proposition – demonstration of the key functionality, a way to solve the problem for potential customers and the benefits of using it.

- Metrics: target audience portrait, metrics achieved so far, major customers, customer returns after first purchase, sales volumes. Clarification of how to increase the value of the solution for the customer and get profit from it. There can be several metrics slides!

- Distinguishing from direct competitors offering similar solutions, products, services. Pointing out that there is no competition is a bad idea. If there is none, indirect competitors operating in close niches are given for comparison.

- Development Outlook. The most important slide in the seed rounds. The volume of the market and its possible growth in case of implementation of the solution, forecast of future revenues – the page is always of interest to investors.

- The business model is the most valuable page of the presentation, which investors always pay attention to. It contains a description of how to make money, revenue streams, payback, profit for the investor and ways to support their involvement. Specifies sets of variables affecting the project, as well as optimistic and pessimistic development scenarios.

- The team, its qualifications and joint successes. Facts, important milestones, achievements.The team and its founders are important to investors in the startup. The success of the funding rests on their experience, expertise and reputation.

- Financial report. If the investment is planned for the first time, the level of achievements with minimal funding is emphasized. The amount of money required and how it will be used is rarely stated in the presentation. This information is voiced during a face-to-face meeting with investors.

When preparing a presentation, it is worth considering effective techniques for presenting information:

- Minimal text. Emphasis on the visual component, which is sufficient to understand the essence.

- Information plus graphics present important data in an easy-to-understand format.

- Unique fonts. Stand out the presentation, make it original.

- Laconic and minimalist design. Superfluous details distract from the main point.

- Color trends, both in fashion and in digital they vary from year to year.

After the presentation is prepared, the pitch is worked through. Other team members are involved in the rehearsal. You need to be an expert and be able to easily answer any questions about the startup topic.

Finding an investor for an IT startup

At the seed stage, the search for an investor can take from 12.5 to 40 weeks. It is necessary to understand that patience is a good quality, but the problem of inattention of investors may lie in the lack of preparation of the presentation.

If the investor is not within three to four months, it is recommended to reconsider the project or abandon it. In the case of a restart, after all the flaws have been corrected, the search period for investors does not exceed 9 weeks.

A large number of meetings with investors is not the best indicator for a startup. You can ask questions about the reasons for refusals, in order to fix the situation before meeting with other investors.

The most common investors are:

- Business angels are managers who have a vested interest in the development of the project. Despite the seemingly powerful support at the initial stage, later on the guaranteed investment of funds and stable support depend on the state of the financial market and the angel’s location.

- Seed investors – venture funds that have a financial interest in the promotion of the startup and give the required amount of money much faster. Investment professionals share their attention on a limited basis, but make additional investments in interesting projects on a regular basis.

The result of a well-crafted presentation is getting investment for further product development and, eventually, entering the market.