A huge number of start-ups are emerging in the field of information technology, which cannot implement an idea without investment. Venture capital funds, working with investment projects and enterprises, finance risky projects that can bring high profits in the future. Most of the invested projects turn out to be unviable, but those that break through to the market pay for their losses.

What is venture capital investment in the IT sphere

Venture capital investment is the acquisition of a smaller share of a controlling stake, charter capital or equity capital in young companies that show high potential. A venture capital fund investment is a long-term investment that results in a staggering return.

The investments are made with private equity capital in high-tech companies which develop knowledge-intensive products. Thanks to the influx of money, the business is boosted. Half of all investments of venture capital funds are in the IT market.

Startups are based on innovations, due to which there is no competition and new services, products, business processes are created, market niches are opened which are not occupied by anyone. Such a position allows a startup to grow quickly, including in price. By investing in an innovative project, the investor earns an increase in the value of the share.

The high percentage of investment in the information technology segment can be explained by several factors:

- low entry threshold;

- Absence of customs and regulatory barriers;

- short development cycle, fast efficiency without investments in infrastructure development;

- absence of physical assets;

- easy relocation of the startup team;

- a high rate of return on the amount of capital invested.

Good, strong IT projects have a higher entry threshold. International investment funds offer different conditions of support (financial, operational, administrative, with the involvement of business angels), working with projects at different stages.

Every startup has to go through several stages in its development, but most startups go bankrupt due to lack of funding, lack of experience or unrealizability of the idea.

At the early stage, a business plan is developed and a product prototype is created using your own financial savings. Its development requires a much larger budget, and any obstacles in the way of development reduce the probability of the startup’s breakthrough to the market – ideas float in the air.

The speed of capturing the market determines the amount of profit, the faster, the higher the price, as well as the risk of losing the investment. At this stage, investments are made by business angels, gas pedals, seed and venture funds.

In the middle and late stages, when it is already known that the startup remains afloat, investment risks decrease, and the prospect of innovation becomes clear. Large venture funds and corporate investors prefer to wait until the moment when startup screening costs decrease.

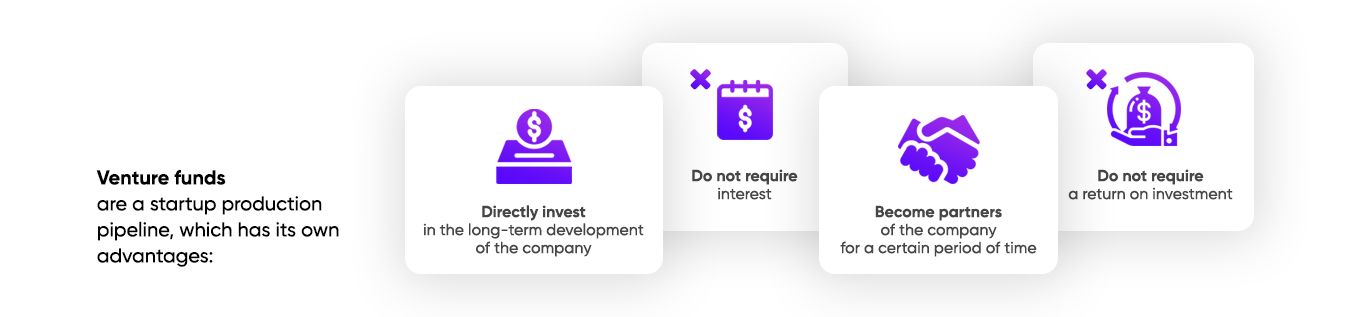

Venture funds are a startup production pipeline, which has its own advantages:

- directly invest in the long-term development of the company;

- do not require interest or monthly payments;

- become partners of the company for a certain period of time;

- do not require a return on investment in case of bankruptcy or low returns.

After the startup reaches the scaling limits, or according to the fund’s requirements, when the value of the company increases as much as possible, the sale of the investor’s share takes place. As a result, the fund gains experience in building companies and managing them optimally.

How does a venture capital fund work?

Startups are evaluated by specialists in economics and investment activities. Their task is to assess the feasibility of investing in the idea, to help the organizers of the project to bring it to the market and receive direct financial benefit. To do this, investors:

- look for profitable, promising ideas;

- they study the object of investment in terms of risks, relevance, demand, and costs;

- they draw up a development strategy;

- they issue shares, buying them back in an amount slightly smaller than the controlling stake;

- develop the company, contribute to its expansion;

- sell their stake and make a profit.

The main problems of investing for venture capital funds:

- Misassessment of the project. The fund experts need time to make a decision and not to miscalculate, and startups need to be patient, regularly reminding in letters about the progress of the project.

- Overload. Investors receive a huge number of presentations in which few people really describe the problem and the way it is solved in a concise, clear and to the point way, evaluating the competence of the team and the amount of work done. As a result, promising projects can go unnoticed.

- Exaggerated estimates. When evaluating a startup and its associated risks, a fund may find that the requested amount is repeatedly inflated.

- Trends. They invest in IT projects that are currently trending (Edtech, Biotech, ESG), to the detriment of practical fields (IT in agro-technology, Deeptech).

- Slowness. A startup is all about getting off to a quick start and getting results. If the process is stretched out, the project loses relevance.

How venture funds evaluate IT startups

The increasing pace of digitalization, the development of information technology, serious fluctuations in the stock market, the growth of IT content and solutions consumption makes the segment promising for investment. The most promising areas for investors are those based on the intersection of innovative and classic technologies – Fintech, Edtech, Helthtech, machine learning and artificial intelligence, SaaS, e-commerce, blockchain, etc.

The interest of investors in the IT sector is also caused by the fact that the development of software services and products requires reasonable, small sums, but the return can surpass the boldest expectations.

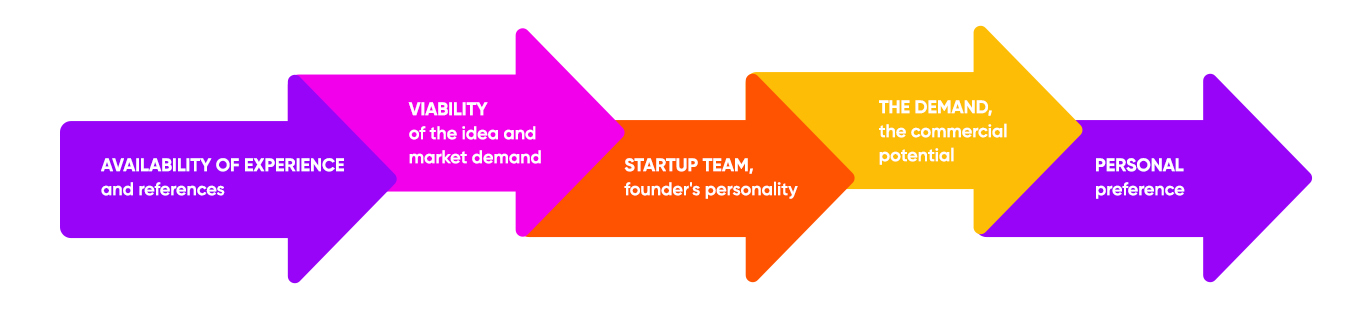

Each venture fund operates with its own criteria for selecting projects, but in general, the parameters are related to the following points:

- Availability of experience and references. Even past failures show that you are working on your mistakes. Do not send letters to a “cold” box, you need to make personal contact or find a business partner who will make a recommendation.

- viability of the idea. The venture fund is not interested in the idea, but its implementation and market demand, and how effectively it solves the problems of the target audience, surpassing the products of competitors.

- Startup team, founder’s personality. A good, professional team demonstrates the seriousness of the intentions to create an interesting, consumer-valuable IT product and conquer the market.

- The demand, the commercial potential. After creating a prototype, testing, and adapting to the market, the chance of getting funding is higher. Sometimes, refinements can turn a service or product into a sought-after product.

- Personal preference. Venture funds and business angels may be interested in developments in the niches that are closer, clearer and more interesting to them.

With a tremendous amount of experience, an investment fund is looking for worthy ideas to implement.

How to win the support of a venture capital fund

To attract a venture capitalist, you need to have an interesting idea, a market need, and a business plan. There are not many funds who are ready to finance a company in exchange for a share in it. You need to prepare a presentation for an investor and present your idea in such a way that a desire to invest in it arises. It is important to discover new things and prove that all of humanity needs an innovative idea!

- Choice of venture capital fund. It is better to apply to those funds which specialize in projects in the IT segment. As a rule, in addition to financing, the startup is interested in qualified assistance and having a partner on the path of business development. It is important to clarify the size of the investment, the depth of the investor’s immersion in the projects, and the fund’s experience.

- Presentation. The brevity of the presentation, enthusiasm and professionalism of the team, and profitability are important to the fund’s representatives. The investor’s attention depends on how well-prepared the presentation is.

- Negotiations. The fate of the project depends on them. The investor pays attention to how well-prepared, ambitious and goal-oriented the startup founder is. His task is to understand the startup’s limits and readiness for cooperation.

- Financial model for several years. It should take into account profits, expenses, all financial flows, and methods that can be applied in case of contingencies. It is important for the venture fund to understand the risk-profit ratio in the future.

- Contract. The contract should be concluded with the assistance of a lawyer, who can assess the contract, explain its nuances and possible pitfalls. The venture fund reserves the right to offer other terms of cooperation than those previously agreed upon in order to smooth the risks and get the indicated returns.

Cooperation between start-ups and venture funds has many advantages for both parties. The participants of the process require the baggage of knowledge, the ability to implement the most daring ideas, and economic experience – only in this case startups will receive money for development, and investors will invest in promising projects, earning money for their subsequent implementation.